Weekly Fraud Update from West Mercia Police

|

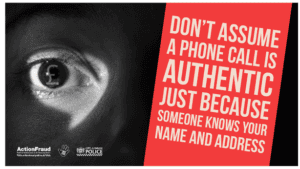

Although we covered Courier Fraud in last week’s message, we are still seeing a large spike in Courier Fraud attempts and spurious phone calls from persons purporting to be police officers contacting elderly and vulnerable people, predominantly in the Hereford and Shropshire areas.

Why is it called “Courier Fraud”?

You panic – this sounds serious.

How can you help? If you know what to look out for, you can help protect not only yourself, but also those you care about. Nationally, total losses to Courier Frauds exceeds £12 million and average personal losses are in excess of £4,000 with some individuals losing much higher figures. So stay in control Please feel free to share these messages with any vulnerable friends, relatives or neighbours Take Five To Stop Fraud STOP: Taking a moment to stop and think before parting with your money or information could keep you safe. ALWAYS REMEMBER: Scam Text messages can be forwarded to 7726 to help phone providers take early action and block numbers that generate spam on their networks. Forward Fake Emails received to report@phishing.gov.uk.

|